Losing a loved one is always difficult, and it becomes even more challenging when you have to deal with their digital assets, including passwords to various online accounts. In today’s digital age, we have an increasing number of online accounts, and it’s crucial to have a plan in place to pass on your passwords when you die. In this blog post, we will explore different methods and techniques to ensure a smooth and secure transition of your digital assets to your loved ones.

Video Tutorial:

What’s Needed

To pass on your passwords when you die, you will need a comprehensive list of all your online accounts, including usernames and passwords. It’s also essential to have a trusted individual who will handle your digital assets and understand your wishes. Additionally, you may want to consider using a password manager to securely store and share your passwords.

What Requires Your Focus?

When it comes to passing on your passwords, there are a few key areas that require your attention. First, you need to ensure that your password list is regularly updated and accessible. Second, you must consider the security of your passwords and how to share them securely with your chosen individual. Finally, you need to communicate your wishes and instructions clearly to your loved ones, so they know how to access and manage your digital assets after your passing.

Method 1. Using a Password Manager

Using a password manager is an efficient and secure way to store and share your passwords. Before we dive into the steps, let’s understand why a password manager is an excellent option.

A password manager is a digital vault that stores your passwords in an encrypted format. It allows you to generate complex and unique passwords for each of your online accounts, making it more difficult for hackers to gain unauthorized access. Additionally, most password managers have a sharing feature that enables you to share your passwords securely with trusted individuals.

Now, let’s go through the steps to pass on your passwords using a password manager:

Step 1. Choose a password manager: Research and select a reliable and reputable password manager that aligns with your needs and preferences.

Step 2. Create an account: Sign up for an account with your chosen password manager.

Step 3. Add your online accounts: Start by adding your online accounts to the password manager. Include the account name, username, and password.

Step 4. Share access with a trusted individual: Use the sharing feature of the password manager to grant access to a trusted individual. Make sure you understand the sharing options and choose the appropriate level of access.

Step 5. Update and maintain your password list: Regularly update your password manager with any changes or additions to your online accounts.

Pros:

1. Provides a secure and encrypted storage for your passwords.

2. Allows you to generate strong and unique passwords.

3. Simplifies the process of sharing passwords with trusted individuals.

Cons:

1. Requires an initial setup and learning curve to use effectively.

2. Relies on the security of the password manager provider.

3. Some password managers may have a subscription fee.

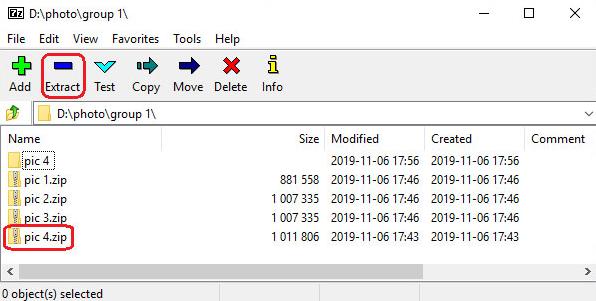

Method 2. Via Password-Protected Document

If you prefer a more traditional approach, you can pass on your passwords using a password-protected document. Here’s how you can do it:

Step 1. Choose a document format: Select a document format that allows password protection, such as a Word document or PDF.

Step 2. Create a new document: Open the chosen document format and create a new file.

Step 3. Add your passwords: Create a list of your online accounts, including usernames and passwords, in the document.

Step 4. Password protect the document: Use the document’s built-in password protection feature to secure the file. Set a strong and unique password.

Step 5. Share the password and document: Communicate the password to your trusted individual and share the password-protected document securely.

Pros:

1. No need for additional software or tools.

2. Provides a familiar and straightforward method for sharing passwords.

3. Can be easily updated and modified as needed.

Cons:

1. Relies on the strength and security of the password.

2. Requires manual updates whenever passwords are changed or new accounts are created.

3. Document may be vulnerable to unauthorized access if not stored securely.

Method 3. Using Encrypted Email

Another method to pass on your passwords is through encrypted email. Encryption adds an extra layer of security to your communication, ensuring that only the intended recipient can access the information.

Here’s how you can share your passwords through encrypted email:

Step 1. Choose an encrypted email service: Research and select a reliable encrypted email service provider.

Step 2. Set up an encrypted email account: Sign up for an account with the chosen encrypted email service provider.

Step 3. Compose an email with the passwords: Create an email containing the list of your online accounts, including usernames and passwords.

Step 4. Encrypt the email: Use the encryption feature provided by the email service to encrypt the email and its attachments.

Step 5. Share the password and email: Provide the password to your trusted individual separately and instruct them on how to access the encrypted email.

Pros:

1. Utilizes strong encryption to protect sensitive information.

2. Allows for secure communication of passwords.

3. Can be easily updated by sending a new encrypted email.

Cons:

1. Requires the use of an encrypted email service.

2. Both the sender and recipient need to have access to encryption tools.

3. Relies on the security of the encrypted email service provider.

Method 4. Using a Digital Legacy Service

If you want a more comprehensive approach to handle your digital assets after your passing, you can consider using a digital legacy service. These services provide a platform to store and manage your digital assets, including passwords, documents, and instructions. Here’s how you can use a digital legacy service:

Step 1. Research digital legacy services: Explore different digital legacy service providers and choose one that suits your needs.

Step 2. Sign up for an account: Create an account with the chosen digital legacy service.

Step 3. Store your passwords and documents: Add your passwords, documents, and any other relevant information to your digital legacy service account.

Step 4. Assign beneficiaries: Specify the individuals or organizations who will receive access to your digital legacy after your passing.

Step 5. Update and maintain your digital legacy: Regularly update and review your digital legacy to ensure it remains accurate and up-to-date.

Pros:

1. Provides a comprehensive solution for managing and passing on your digital assets.

2. Ensures a structured and secure platform for your passwords.

3. Allows you to include additional instructions and documents related to your digital assets.

Cons:

1. May require a subscription or payment for access to advanced features.

2. Relies on the security and reliability of the digital legacy service provider.

3. Requires trust in the digital legacy service provider to handle your sensitive information appropriately.

Why Can’t I Access My Loved One’s Accounts?

Losing access to a loved one’s accounts can be frustrating and emotionally challenging. Here are a few reasons why you may encounter difficulties accessing their accounts and potential fixes:

1. Lack of knowledge or documentation: If your loved one did not provide any information about their accounts, it can be challenging to gain access. To avoid this, encourage your loved ones to create a password plan or use one of the methods mentioned above to pass on their passwords.

2. Privacy policies and legal restrictions: Some online service providers have strict privacy policies and legal requirements that prevent unauthorized access to accounts. In such cases, you may need to provide legal documentation, such as a death certificate or power of attorney, to gain access. Contact the respective service providers for guidance.

3. Two-factor authentication: If your loved one enabled two-factor authentication for their accounts, you may need access to their registered devices or authentication codes. It’s essential to discuss and plan for this scenario by considering alternatives, such as providing backup authentication codes.

Implications and Recommendations

When passing on your passwords, you’ll face several implications and challenges. Here are a few recommendations to ensure a smooth and secure transition of your digital assets:

1. Regularly update your password list: Keep your password list up-to-date by adding new accounts and removing old ones.

2. Use strong and unique passwords: Generate strong and unique passwords for each of your online accounts to enhance security.

3. Educate your loved ones: Inform your trusted individual about the importance of managing and securing digital assets and provide them with instructions on how to access your passwords.

4. Consider professional help: If you have complex or extensive digital assets, consider consulting an estate planning attorney or digital legacy service.

5. Review and update your plan regularly: Life circumstances and online services change, so it’s essential to review and update your password passing plan periodically.

5 FAQs about Passing on Passwords

Q1: What happens if I don’t pass on my passwords when I die?

A1: If you don’t pass on your passwords, your loved ones may face challenges accessing and managing your digital assets. This can lead to financial, emotional, and legal complications.

Q2: Can I use the same password for all my accounts?

A2: It’s strongly recommended not to use the same password for all your accounts. If a hacker gains access to one account, they will have access to all your other accounts.

Q3: Can I write down my passwords and keep them in a safe place?

A3: While writing down passwords can be an option, it’s important to keep them secure. Consider using a lockbox or a safe to store your password list.

Q4: Is it safe to share passwords online?

A4: Sharing passwords online can be risky if not done securely. Utilize encrypted methods, such as password managers or encrypted email, to ensure the safety of your passwords.

Q5: What if my trusted individual forgets the password to access my passwords?

A5: To avoid this situation, choose a trusted individual who is reliable and responsible. Discuss the importance of password management, and consider using a secondary method of sharing passwords, such as encrypted email or a physical document.

Final Words

Passing on passwords when you die is a critical step in managing your digital legacy effectively. By using methods like password managers, password-protected documents, encrypted email, or digital legacy services, you can ensure a smooth transition of your digital assets to your loved ones. It’s important to prioritize the security and accessibility of your passwords and regularly update and review your password passing plan. Remember, investing time in planning now can save your loved ones from unnecessary difficulties in the future.{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:null}